INSIGHTS

2024 E-INVOICING

Implementation Of

E-Invoicing Starting 1st August 2024

What is E-Invoice? 什么是E-Invoicing?

An e-lnvoice is a digital representation of a transaction between a supplier and a buyer. e-lnvoice replaces paper or electronic documents such as Invoice , Credit Note , Debit Note , and Refund.

e-lnvoicing 是供应商和买方之间的电子交易记录。e-Invoicing 取代了纸质或电子文档,例如发票、贷记单、借记单和退款。

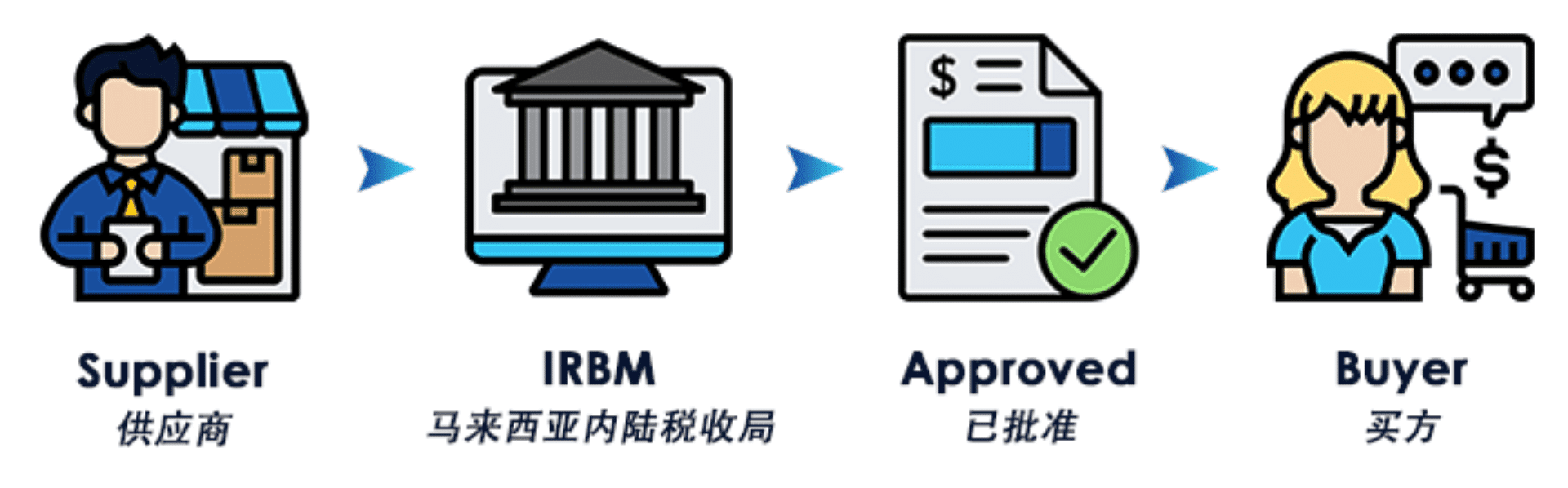

E-Invoicing 流程

Process of E-Invoicing

实施日期

Implementation Date

LHDN e-lnvoicing implemented 18 months earlier!

LHDN e-lnvoicing 提前18个月实施!

53项必要信息

53 Mandatory Info

- General Information (invoice no., e-Invoice type, e-Invoice purpose, e-Invoice date)

一般信息(发票编号、电子发票类型、电子发票用途、电子发票日期) - Supplier & Customer Information (Supp. and Cust.’s TIN, company/individual details etc)

供应商和客户信息(供应商和客户的TIN、公司/个人详细信息等) - Item Information (Description, QTY, UOM, unit price, discount, tax type/code/rate, tax amount etc)

商品信息(描述、数量、计量单位、单价、折扣、税收类型/代码/税率、税额等) - Validation Information (IRBM Unique Identifier No., validation date and time, and validation status)

验证信息(IRBM 独特标识符号、验证日期和时间以及验证状态) - Digital Certificates / Signature

数码证书/签名

SQL如何帮助您?

How SQL Can Help You?

With just one click in SQL Accounting Software, the invoice can be directly and automatically synced to IRB Malaysia’s e-Invoicing platform. Ensuring efficient and real-time submission of invoices to the IRB.

仅需 SQL 会计软件里的一键,发票就可以直接自 动同步到 IRB Malaysia 电子发票平台。 确保高效、实时地向 IRB 提交发票。

立即领取!

Claim It Now!

- FREE SQL e-Invoice Module (Worth RM1,000)

免费 SQL e-Invoice Module (价值 RM1,000) - 50% subsidy discount! Don’t wait until there are no subsidies to buy!

50% 补贴折扣!别等到没有补贴了才买!

E-Invoicing 2024

MSME Digital Grant MADANI – 2023

Call in Now! Limited to First Come, First Served.

中小企业电子补助金

Digital Grant for SMEs

50% 补助金高达 RM5,000

50% grant up to RM5,000

FAQ

Questions Regarding E-Invoicing

Which E-Invoicing frameword will be used in Malaysia?

The Peppol E-Invoicing framework is considered to be the most suitable for implementation in Malaysia due to its maturity, interoperability, and well-governed standards. It is also the most widely used E-Invoicing framework globally, adopted by more than 20 countries. (refer to country list HERE)

What is a Peppol Authority?

The function of a Peppol Authority is to manage the implementation of the Peppol framework in a particular country. This includes localising the Peppol standards to suit local requirements and to accrediting service providers that adhere to the Peppol standards. MDEC functions as the Peppol Authority for Malaysia.

Is it compulsory for every business to implement E-Invoicing for tax reporting?

According to LHDNM’s website, businesses with an annual turnover of RM100 million and above will be mandated to implement e-Invoice for tax compliance on 1st August 2024. The implementation of e-Invoice will be mandatory for all businesses on 1st July 2025. For the latest information on e-Invoicing for tax reporting and compliance, please click here.

We are a large company/business owner. Should I replace my current accounting software/ERP System to adopt this initiative?

You should not be required to replace your current systems. This initiative aims to standardise the specification and message format used for the transmission/exchange of e-invoices between different accounting software/ERP systems. The standardisation of the e-Invoice format is technically configured in your accounting software by your service provider. Consult your accounting service provider to determine whether they can/will support the Peppol framework. If you would like to know more details, you may reach out to us at [email protected]

Is e-Invoice applicable to transactions in Malaysia only?

No, e-Invoice is applicable to both domestic and cross-border transactions. The cross-border transactions include import and export activities.

For clarity, the compliance obligation is from the issuance of e-Invoice perspective. In other words, taxpayers who are within the annual turnover or revenue threshold as specified in Section 1.5 of the e-Invoice Guideline are required to issue and submit e-Invoice for IRBM’s validation according to the implementation timeline.

What are the thresholds for e-Invoice implementation to be applicable to taxpayers?

All taxpayers are required to implement e-Invoice according to the annual turnover or revenue thresholds.

In relation to a company, the annual turnover or revenue threshold refers to the annual turnover or revenue value as stated in the statement of comprehensive income in the FY22 Audited Financial Statements.

Are all industries included in the e-Invoice implementation? Are there any industries exempted?

Currently, there are no industries that are exempted from the e-Invoice implementation.

Note that certain persons and types of income and expense are exempted from e-Invoice implementation. Refer to Section 1.6 of the e-Invoice Guideline for further details.

Will all businesses be required to issue e-Invoice?

Yes, all businesses will be required to issue e-Invoice in accordance to the phased mandatory implementation timeline, which is based on the business’ annual turnover or revenue threshold.

Is there any adjustment window allowed to the supplier to cancel an invoice submitted to IRBM?

Yes, there is a 72-hour timeframe for the e-Invoice to be cancelled by the supplier. Refer to section 2.4.6 of the e-Invoice Guideline for further details.

Call (+60) 4-2999399 or (+60) 16-328 4983 if you need any assistant